This document was written as a fundraising document for Kiran, my old startup in July 2018. I didn’t intend to publish this piece, but I hosted it on my website so I could send it to investors with a special link. However, I didn’t anticipate that many people would find this document via Google. Over time, it has become one of most read pieces on my blog, despite not being directly linked anywhere. I decided that I ought to published an abridged version of this document, in case people find it interesting or useful.

Since I wrote this, lots of things have happened in meat snacks. Country Archer raised $10M in funding and released a line of meat bars. Also, I’ve started seeing Lorissa’s Kitchen in stores, whose branding is seemingly targeted at women.

TL;DR

This study argues for the market opportunity of using cellular agriculture in the US meat snack market, and in particular in creating a cell-based meat bar.

The recent explosion of the popularity of premium beef jerky gives us a window into the minds of meat snack consumers. There is growing demand among affluent consumers for premium meat snacks products. We also see that there is strong interest in meat bars, but that product quality is lagging behind interest. A premium cell-based meat bar that can fix these product quality issues can meet both of these demands.

A better cell-based meat bar sits at the nexus of multiple current trends: the rise of snacking among affluent consumers, and particularly the rise of the popularity of meat snacks, a desire for convenient, healthy sources of protein, and a growing concern over the environmental and public health risks associated with the food we eat.

Background

Meat snacks in the US are a $2.8B market with an expected CAGR of 7.2% until 2023.

Relevant players

Market share in the meat snack industry is highly concentrated, with a small number of large companies controlling a majority of the market. Recently, there has been an explosion of artisanal and craft brands with tiny market shares, oftentimes being regionally concentrated. There is a major shift happening right now away from the big brands, toward these smaller, quality-focused brands [1].

Here we will discuss some of the most relevant players to better understand the competitive landscape.

Jack Links

Jack Links is the largest player in meat snacks, with over $1 billion in sales every year. They mainly sell beef jerky, but have other products like meat sticks and meat bites. In 2017 they had 51% market share for beef jerky, and over ⅓ of the market share for meat snacks as a whole. These numbers are down from 2016, when they had 56% market share for beef jerky. If they continue to lose market share at the same rate as they have been for the last few years, they will have around 40% market share by 2021.

Historically, Jack Links’ main brand has been “convenience store, trucker, gas station” focused, i.e. targeted towards a low-income male-focused consumer-base, emphasizing cheapness and taste over quality and healthiness. Recently, they have been trying to expand pass this image, largely as a response to disruption by brands like Krave. Their marketing is more broadly targeted than before, but they have maintained their focus on cheap tasty products over quality and healthiness.

Krave

Krave is the poster-child for the current disruption by quality-focused brands. They created high-end jerky that was more expensive than their competitors’ but that emphasized quality and healthiness. For consumers, this was a completely new framing of an old, established product. They also innovated in flavoring, coming up with unique flavors like Sweet Chipotle, and Black Cherry Barbeque. These products rode the wave of growing consumer interest in quality-focused snack foods, and achieved a wider appeal than previous jerky brands.

They are still relatively small player in the beef jerky market, but have had astonishing growth over the last couple of years. When they were acquired by Hershey’s in 2015 for between $200M and $300M, they had a yearly revenue of $36M. This was an 100% growth from the previous year, and they plan on maintaining this growth rate in the coming years.

Krave jerky is generally more tender (i.e. higher quality meat), slightly more moist, and more consistent in the size and thickness of each piece. They use high quality meat (e.g. grass-fed, pasture raised), and the ingredients lists are short and simple. Their marketing is focused on quality and health: “KRAVE flavor profiles appeal to everyday jerky lovers and to the discerning palates of today’s food-savvy, health-conscious gourmands.” Krave also came out recently with a line of meat bars.

Epic

Epic Provisions is the largest meat bar producer, and one of the popularizers of the product category. They’ve built a strong premium brand around sustainable, ethically-sourced, high-quality meat, made in ways that are good for the animals and good for the surrounding land. They focus on the naturalness of their meat, creating “bars as nature intended.” Their core consumer-base is the paleo community.

They did $6.8M in sales in their first year of operation, then maintained a 300% yearly growth rate in subsequent years. They were acquired by General Mills in the beginning of 2016 for $100M with yearly sales of $20M. Since their acquisition, they’ve continued to grow and add new product categories.

Chef’s Cut

Chef’s Cut jerky is another major contributor to the jerky renaissance that Krave paved the way for. They are notable for having the highest growth rate of any company in the space at 5,669% over three years. They take the strategy of Krave one step further, creating a premium jerky at an even higher price point. Just like Krave was more tender and moist than conventional jerky, Chef’s Cut is even more tender and moist than Krave. They brand their products as a “steak in a bag.” To establish their premium brand they initially sold in country clubs and golf courses around the country. They have brand partnerships with high profile celebrities like Olivia Munn (actor), Von Miller (American football player), and Kyle Reifers (golfer).

Meat snack products

Meat snacks comprise of a few major categories. The largest category is beef jerky, which accounts for around 50% of the total meat snack market. Meat sticks, such as Slim Jims, are the second largest category, although we won’t discuss these here. There are a number of other meat snack categories, each of which makes up a smaller percent of the total meat snack market. For example, meat bars are a quickly growing category, pioneered by companies like Epic, and Tanka.

Beef Jerky

Beef jerky is the largest category of meat snack, accounting for around 50% of the total market. Historically, beef jerky was marketed as an affordable, tasty, convenient, low-quality snack, and was primarily sold in convenience stores and gas stations. Jack Links is dominant in this segment of the market. More recently, there has a been a “beef jerky renaissance,” led by companies like Krave. Krave capitalized on the growing popularity of quality-focused snacks, and the growing desire for high protein foods, and created a jerky brand that catered to a new higher-income customer segment. Affordable low-quality brands still dominate the market, but this balance could shift in the coming years.

There are various reasons why people like eating beef jerky. One constant is taste, which is important across all consumer segments. Many consumers also like that beef jerky tends to be more filling than other snacks, making it a more satisfying meal supplement. As with all snack foods, convenience is also an important factor. Beef jerky doesn’t weigh a lot and lasts a long time, making it ideal for activities like camping. For some consumers, health (high protein, low fat) is also a major benefit, although not all types of beef jerky are seen as healthy (e.g. teriyaki flavoring often involves high sugar content).

There are also some aspects of beef jerky that consumers don’t like. Some consumers see the toughness of jerky as a downside, although some report enjoying the experience of chewing beef jerky. Krave jerky is less tough than brands like Jack Links, supporting the idea that higher end beef jerky is slightly less tough. Many consumers also report not liking the inconsistency in the thickness of low end beef jerky. Thin pieces tend to be even more tough than normal jerky, and can be difficult to eat. Sometimes low end beef jerky also has inconsistent texture within a single piece. Consumers describe unpleasant “knots” in low end beef jerky. High end brands like Krave and Chef’s Cut tend to be more consistent along both of these parameters–they have a more consistent thickness per piece, and a more consistent texture within a single piece. They also tend to be more tender and contain more moisture than low end jerky. Some consumers report not liking the strong smell of beef jerky.

Beef jerky is preserved in a number of different ways. The main method of preservation is dehydration–beef jerky has around a 25% moisture content, compared with 75% moisture content in typical meat. Jerky can also be cured for further preservation, and the strong spice content often can have antimicrobial effects. Jerky is usually packaged in flat barrier bags, designed to keep moisture content from entering the packaging. Most jerkies are packaged with an oxygen absorber, to further decrease the chance of contamination.

Meat bars

Meat bars are a relatively new product category in meat snacks. Their main differentiator from other meat snacks is that they contain moisture and are relatively soft. They attempt to give a more “authentic” meat experience by being closer to a normal piece of meat. The category was pioneered by Tanka in 2009. Tanka used a Native American technique called “Wasna,” which involves blending buffalo meat with dried cherries. The acidity of the cherries kill bacteria, helping preserve the meat, which is important since meat bars contain moisture. The category gained steam when Epic Provisions created a premium meat bar targeted at paleo consumers. Recently, there has been major growth in the area, with both Krave and Jack Links creating bars aimed at their respective customer segments. Additionally, there are a number of small brands such as Bricks Bar, DNX Bar, and others.

Meat bars are a relatively small segment of the overall meat snack market, although it’s one of the fastest growing categories. We can estimate the exact size by looking at the biggest players in the space. Epic had an annual revenue of $30M when it was acquired in 2016, with a 300% yearly growth rate. Assuming that growth was maintained since acquisition, their 2017 revenue would be around $90M. Krave is the second largest brand although we don’t know exactly how much they have been selling since they primarily sell jerky. Let’s assume they sell $15M per year, which would be about 10% of their of their sales given roughly constant growth since their acquisition. Finally, Tanka had $3.5M in revenue in 2016 with a 42% CAGR, meaning their revenue in 2017 was around $4.9M. If we assume the rest of the brands combined have $5M in revenue, the total meat bar market would be around $115M, or around 4% of the total meat snack market. This would also give them around a 100% CAGR, the fastest growing meat snack segment. If meat bars as a whole had a 50% CAGR for the next few years, the meat bar market would be $580M by 2021–16% of the total project meat snack market.

People tend to like meat bars for similar reasons to why they like beef jerky. Meat bars are convenient to eat, and have a meaty taste that’s hard to get from other snacks. They also tend to have good nutritional profiles, with high protein, low fat, low carbs, and low sugar. There are a couple benefits to meat bars over beef jerky: they are easier to eat quickly since they are soft and thick, meaning they assuage hunger more effectively, and they are a “fresher” meat experience than jerky. Because they are easier to eat than jerky while retaining the healthy nutritional profile, they are more popular than jerky as a meal supplement, or meal replacement. Some people use meat bars as replacement for energy and nutrition bars, which was a $2.5B market in the US in 2015.

Meat bars struggle to meet consumers’ expectations on taste. Epic bars consistently have low reviews on Amazon, and online reviews tend to be lukewarm, and even sometimes disgusted. One of the main difficulties that meat bars have is that it is very difficult to prevent contamination. Bacteria naturally thrive on the moisture present in a meat bar. Companies get around this be mixing in acidic fruits or spices with antimicrobial properties (calling back to the Native American technique of Wasna). However, these techniques degrade the quality of the meat by denaturing the proteins. This give some bars a dense, mealy texture that turns consumers off. Additionally the use of fruits restricts the types of flavor profiles the bars can have.

The acidic fruits are not enough to fully preserve the meat bars. Some brands use encapsulated lactic acid as a preservative. Meat bars are generally vacuum sealed to further restrict bacterial growth. Jack Links is the exception to this–their new beef steak stick is not vacuum sealed, but each bar comes with an individual oxygen absorber. Despite all of this, some meat bars still have a shelf life as short as two months.

Meat bars are still a relatively new product category, so there are a few different ways that consumers conceptualize what a meat bar is. The most common way to conceptualize a meat bar is as a extension / modification of beef jerky. People might think that meat bars are trying to fill the same role as beef jerky, but provide variety and value in certain areas by being softer and having more moisture. Another way to conceptualize meat bars are as a type of nutrition bar, or meal supplement bar. Consumers might conceptualize meat bars this way if they are using meat bars mainly as a source of protein, or as a replacement for an energy and nutrition bar. Finally, some consumers conceptualize meat bars as an attempt to conveniently package fresh meat. Paradoxically, this conceptualization can be seen by meat bars’ biggest supports and their biggest detractors. Meat bar supporters see bars as attempt to take what we love about eating a piece of meat, and make it accessible at any time. Meat bar detractors are turned off by the idea of a meat bar, finding it odd that one would eat e.g. a chicken in bar form. This disgust comes from a sense that in order for meat to be formed into a bar shape, and packaged well enough to not be contaminated, it must have had a large amount of processing behind the scenes. Part of the Epic Bar’s success is likely because they got out in front of this idea, and explicitly branded their product as natural and organic.

For example, this reviewer exhibits both mindsets in a single review. After trying one flavor of Epic Bar and being disappointed, she says “Sometimes, when I really want something to work out, I refuse to let it go,” implying that she is attached to the idea of having access to a convenience form of fresh meat. She also says “the Epic Bison Meat Bar turned out to be just as gross as one would expect a meat bar to be.” She expected the meat bar to be weird because the idea of having a bar shaped, moist piece of meat seems impossible without a large amount of processing.

Customer Segments

Our consumer research has consisted of interviews, analysis of the marketing of current players, product reviews, and reports by external parties. We have identified three relevant customer segments:

Value Focused

Value focused consumers were the original consumers of meat snacks. They are highly sensitive to taste and price, but not sensitive to quality or healthiness. They have lower income on average and are concentrated outside of urban areas. They typically purchase meat snacks at convenience stores and gas stations. This group is slightly biased towards men, although women still make up a large percent of the customer base. Jack Links directly targets this customer segment with affordable, low quality, tasty products.

Value focused consumers are not the target of most meat bar brands, because meat bars are often expensive ($2-$3 / bar). Jack Links is currently experimenting with a meat bar targeted towards this segment called the beef steak strip, priced at $1 per bar.

Affluent Snackers

Affluent snackers have been driving the massive growth of quality-focused snacks in recent years. Krave brought this trend to beef jerky with a premium beef jerky product targeted at this consumer segment. Affluent snackers are very sensitive to taste, and also care about healthiness and quality. They are naturally less price sensitive since they tend to be more affluent, and they often get food through their work (for example, Google carries Krave in their micro kitchens). The group tends to be balanced across genders. They are distinct from the value focused segment because they are less price sensitive and care more about quality and healthiness, and they are distinct from paleo segment because they care more about taste, and less about quality and healthiness.

This segment is very interested in meat bars because they see it as an intriguing and new snacking experience, and they are willing to pay higher prices.

Paleo

Paleo is a quickly growing movement built around the idea that one’s lifestyle, and in particular one’s diet, should resemble what our ancient ancestors would have done. A paleo lifestyle is often very physically active, and a paleo diet usually contains a lot of meat. Someone can be paleo for either ideological, or practical (i.e. health) reasons. Meat snacks are popular among the paleo community because they are convenient to eat for an active lifestyle, and they often are high protein, low fat, low carb, and low sugar.

Paleo consumers are highly sensitive to quality and healthiness, but less sensitive to price. They still care about the taste of the product, but to a lesser extent than other segments. The tend to avoid GMOs and chemicals, favoring natural, organic, and grass-fed meats. They have higher income on average, and usually purchase meat snacks through online retailers, or speciality grocery stores like Whole Foods. They are slightly biased towards women, although men make up a large part of the consumer base (and may eat more meat snacks than women). Epic directly targets this consumer segment with high-quality, health-focused premium meat bars.

Strict adherents to the paleo diet are a small group, but aspects of their ideology are shared by others in the affluent snackers segment. For example, many affluent snackers prefer high quality, natural ingredients and minimal food processing.

This segmented is very interested in meat bars because they see it as a convenient, high-quality snack product that allows them to maintain a healthy lifestyle.

Analysis

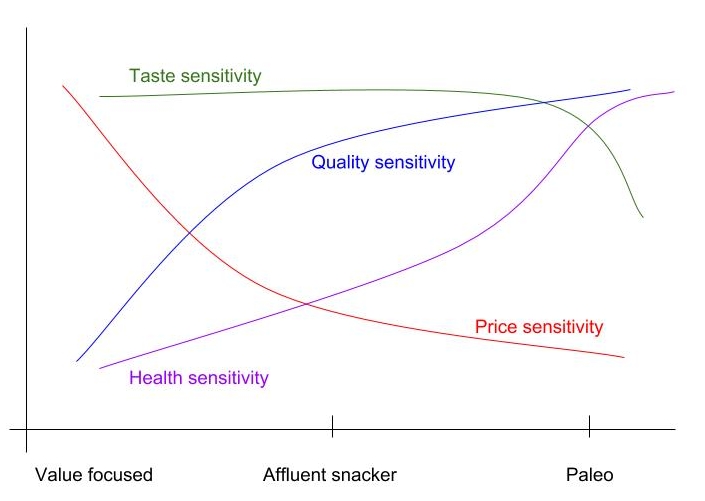

Affluent snackers represent a broad and heterogenous body of consumers. Some are more sensitive to price than others, and some value health and quality more than others. The three customer segments can be seen as a spectrum from value focused, to affluent snackers, to paleo.

All customer segments are very sensitive to taste, although paleos are slightly less sensitive. Sensitivity to both quality and healthiness go up from value focused consumers, to affluent snackers, then to paleos. Both affluent snackers and paleos tend to be more tolerant of price than value focused consumers.

Products

We are targeting the meat snack market because we can solve one of the major problems in the industry: preservation. Because meat snacks are not refrigerated, producers have to employ a number of preservation techniques, all of which degrade the quality of the end product. Beef jerky is heavily dehydrated, and uses preservative chemicals like nitrates and nitrites. Meat bars are even more difficult because they contain moisture. In addition to vacuum sealing packaging, and using preservative chemicals, producers have built preservation into the recipes of their products–Epic bars use acidic fruits to kill bacteria, but the acidity also denatures proteins in the meat, leading to a less fresh taste, and a mealy texture.

This problem is mitigated with cellular agriculture. Because bioreactors already require aseptic conditions, we can have minimal bacterial exposure all the way until packaging. Our preservation requirements will be much less, allowing us to have a higher quality product, with lower risk of contamination and a longer shelf life. The longer shelf life will be especially beneficial for distributors, as there will be less spoilage, and longer possible supply chains.

The products that we make will capitalize on this competitive advantage of cellular agriculture.

A Better Meat Bar

One product that’s especially well suited to cellular agriculture is a better meat bar. Since we will not need to use acidic fruit or other preservatives, we will have higher quality meat, and greater flexibility in our flavor profiles. Because our meat will have lower acidity, we will have a more authentic meat texture and a fresher meat taste. Additionally, our meat bars will have lower risk of contamination and a longer shelf life.

This is a promising avenue of commercialization for a few reasons. Companies like Epic and Krave have shown that there is strong consumer demand for meat bars, both among paleos and among affluent snackers. However, Epic and other meat bar companies have constantly struggled with product quality issues. If these quality issues were fixed, the meat bar segment would likely be growing faster than it already is.

Additionally, meat bars are easy to tackle technically. They have a homogenous texture and lack the structure of a tissue. Additionally, since meat bars are a developing product category, the range of acceptable taste and textures is broader than in a more established category like ground beef. This product flexibility translates to technical flexibility–we can pursue promising research paths without worrying about if it will make us drift off the taste and texture of a well established product like ground beef or foie gras.

Target Consumer

Our target consumer base can be divided into those who care about cell-based meat (called “early adopters”), and those who care about a better meat bar (called “target consumer”). Our strategy will be to allow our early adopters to come to us naturally, while actively marketing towards our target consumer.

Our target consumers are a similar group that Krave targets–affluent snackers, plus some value oriented meat snack consumers, plus some paleos. Many value oriented consumers will be priced out of our products, although a small subgroup will be willing to pay a price premium for a better product. Paleos are likely to be split–paleos can be further divided into ideologically motivated paleos, and health motivated paleos. Health motivated paleos will likely be drawn to our products for the same reasons that affluent snackers are, but ideologically motivated paleos will likely be turned off by the use of new technology. However, this is a relatively small consumer segment.

Justification for targeting this subsection of consumers is drawn from looking at the recent developments in the beef jerky and meat bar markets. The beef jerky renaissance ushered in by Krave has demonstrated that there is robust, growing demand for high quality, high price point meat snack products. Further, companies like Epic have demonstrated that meat bars have a lot of growth potential, despite current product quality issues. While Epic was mainly targeting a paleo consumer base, Krave’s later move into the meat bar market demonstrates that this product has potential among affluent snackers as well. By solving the product quality issues that hold back the meat bar we can establish a dominant position in the meat bar market and accelerate its growth.

On the other hand, our early adopters can be further divided into vegans and vegetarians (“veg*ans”), and futurists.

Veg*ans care about cell-based meat because it is a more humane and sustainable way to create meat. Not every person who has a veg*an diet will be in the early adopter group. If someone adopts a veg*an diet solely because they believe it is healthier, they won’t naturally be drawn to cell-based meat (although cell-based meat might have some health benefits over animals meat). Around 30% of people with a veg*an diet explicitly don’t list health as a reason for their diet. Therefore, we can estimate the 30% of people who have a veg*an diet will be early adopters. This is a conservative estimate, since generally people have multiple reasons for adopting a veg*an diet.

Futurists are the other subgroup of our early adopters. They care about cell-based meat because they are interested in the ways that technology will change society. They often value sustainability and public health, but may also be interested in other issues like interstellar agriculture. This group is harder to exactly define and measure, but their interest can be demonstrated through the r/futurology subreddit, which contains over 13 million people from around the globe. There are consistently new posts about cell-based meat in this subreddit, and some of them were the most upvoted posts of all time.

Go to Market Strategy

Our go to market strategy could be a useful tool for targeting the affluent snacker segment. Companies like Impossible Foods began building a premium brand by selling Impossible Burgers through high-end restaurants. We can’t use this exact strategy since we are selling snacks, but similar strategies exist. For example, Chef’s Cut built its brand by selling jerky at country clubs and golf courses. We can follow in Chef’s Cut’s footsteps and target country clubs, but we could also target high-end gyms and yoga studios, art museums, or beach resorts.

Footnotes

[1] I am using a very broad notion of quality here, distinct from price or taste. Quality-focused products make you trust that they were made well. They might have sleek branding and be sold at a slight premium. You are assured won’t get anything spoiled, and that the ingredients are generally the healthiest options. Quality-focused brands often tout labels like organic, non-GMO, allergen free, fair trade, etc. Quality-focused products are usually targeted at high-income consumers, even if they aren’t necessarily pricier or tastier.